minnesota unemployment income tax refund

100 percent is deducted from your weekly benefit payment. Minnesota Unemployment Refund Update.

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify

Base Tax Rate for 2022 from 050 to 010.

. Employers with an active employer account must submit a wage detail report even when no covered wages were paid. The refunds totaled more than 510 million. If you received an unemployment benefit payment at any point in 2021 we will provide you a tax document called the 1099-G.

The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income. You may only take this deduction if you claim Minnesota itemized deductions.

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. It is expected the number of returns processed each week will increase with a goal of processing 500000 returns per week by late October.

Without that law Minnesota businesses were set to suffer a 30 increase in their unemployment taxes triggered when the fund is below a certain threshold. Premium federal filing is 100 free with no upgrades for premium taxes. September 15 2021 by Sara Beavers.

Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. For more information on this new law refer to Unemployment tax changes. State lawmakers managed to pass the law SF 2677 the day before the April 30 deadline to submit taxes but alas some businesses had already paid their quarterly taxes at the higher rate.

The Taxable wage base for 2022 is 38000. Repayment of 3000 or Less In the year of repayment you may take a miscellaneous itemized deduction for ordinary income items such as unemployment on line 24 of your Schedule M1SA Minnesota Itemized Deductions. This is the latest round of refunds related to the added tax exemption for the first 10200 of unemployment benefits.

Contact Us with Questions. Your deduction is subject to the 2 floor. Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the COVID-19 pandemic.

The new law reduces the. On Thursday September 9 th. September 09 2021 ST.

A spokesman for the Minnesota Department of Revenue said taxpayers dont need to take. Ad Learn How Long It Could Take Your 2021 State Tax Refund. 2020 Adjustments Individual and Business Income Taxes Property Tax Refund Section 179 Trusts Contact Info Email Contact form Phone 651-556-3000 800-657-3666 Hours Address Last Updated December 02 2021.

Revenue will begin manually processing about 1000 individual income tax returns per week to start. Taxpayers who excluded grants or forgivable loan income from these programs on their federal tax return must add it back to their Minnesota returns. Reports must be received on or before the last day of the month following the end of the calendar quarter.

Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. Additional Assessment for 2022 from 1400 to 000. Minnesotas divided Legislature has agreed to provide nearly 1 billion in tax relief over the next four years focusing on businesses that received federal payroll loans and workers who collected unemployment checks during the COVID-19 pandemicThe final agreement also extends tax credits for preserving historic buildings and film production in Minnesota while.

Unemployment benefits are taxable under both federal and Minnesota law. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. The current process allows for 1000 refunds to go out per week with anticipation for up to 50000 to go out per week by the end of October.

A pension of 433 per month 100 per week so UI benefits would be reduced 100 per week. Pension or 401K payments. FOX 9 - Many Minnesota tax filers will get an automatic refund within weeks because of tax breaks passed overnight by lawmakers state Revenue Department officials said.

Use the appropriate nonconformity schedule or follow the form instructions for federal adjustments for the year the income was received. Law changes 2022 Base Tax Rate changed from 050 to 010 2022 Additional Assessment changed from 1400 to 000 2022 Special Assessment Federal Interest Loan Assessment changed from 180 to 000 Implementing the law change. How they affect you.

Ad File your unemployment tax return free. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022. 100 free federal filing for everyone.

Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year. We know these refunds are important to those taxpayers who have experienced hardships over the last year and a half said Department of Revenue Commissioner Robert Doty. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

If you retire from your base period employer your monthly pension payments will reduce your unemployment benefits dollar for dollar. See How Long It Could Take Your 2021 State Tax Refund. Check For The Latest Updates And Resources Throughout The Tax Season.

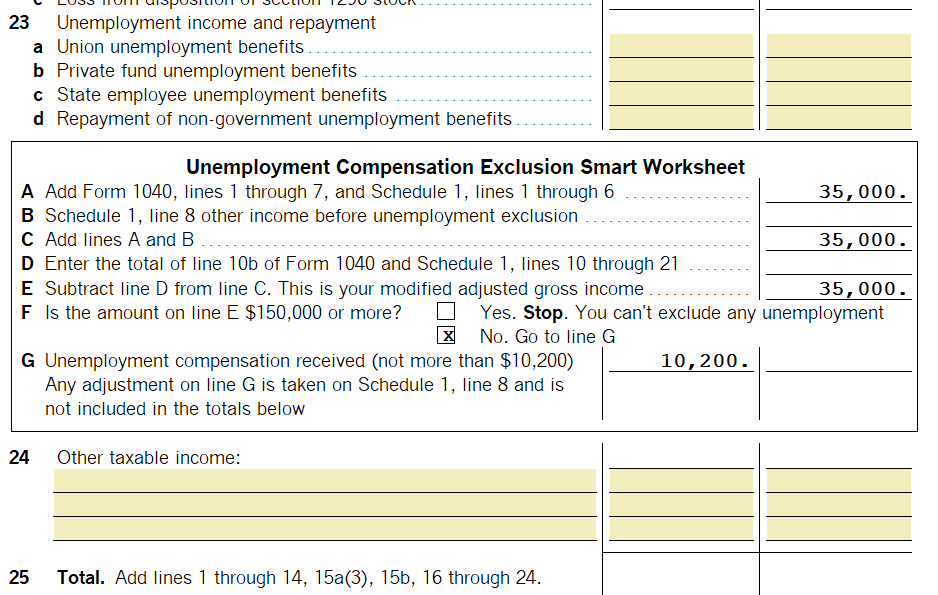

Generating The Unemployment Compensation Exclusion In Proseries

When Will Irs Send Unemployment Tax Refunds 11alive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

State Income Tax Returns And Unemployment Compensation

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

How To Get A Refund For Taxes On Unemployment Benefits Solid State

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

667k Minnesota Workers To Get Pandemic Hero Pay Bonuses Ap News

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Where S My Refund Minnesota H R Block

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News